Any not-for-profit organization or an NGO can register itself as a trust by executing a trust deed or as a society under the Registrar of Societies, or as a not-for-profit company under Section 8 Company of the Companies Act, 2013. A Section 8 Company is a special entity and the same as a Section 25 company under The Old Companies Act, 1956. Under The New Companies Act 2013, Section 25 Companies have now been renamed as Section 8 Companies. As per section 8(1a, 1b, 1c) of the Companies Act, 2013, “A Section 8 company can be established for the promotion of commerce, art, science, sports, education, research, social welfare, religion, charity, protection of environment or any such other object”. The Act further clarifies that the Section 8 companies can pursue the above motives, subject to the condition that it “Intends to apply the profits, if any, or other income in promoting its objects and intends to prohibit the payment of any dividend to its members”. In simpler words, a Section 8 Company has to endorse a public cause and the proceeds created by the entity have to be solely used to support the stated public cause(s).

The following are the major advantages of incorporating a private limited company in India versus other entity types.

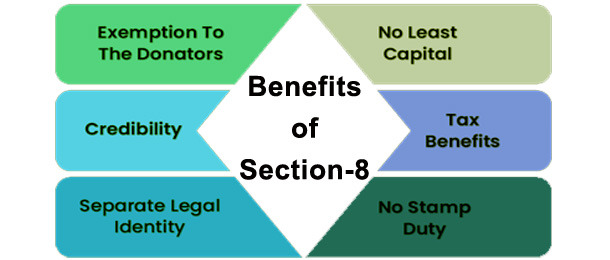

Through building the section-8 company the intention or goal of the company would perform any activity and obtain integrity and commitment because the same is being approved made through the Union government.

Towards the operations because of its strict rules the same poses trustful image in front of an internal and external user of the details with respect to the communities.

The reliability of section 8 company has much more with respect to the communities and the additional kinds of charitable firms.

Grants and subsidies via the government and the additional institutions were acknowledged to the section-8 company according to the communities of trust.

An individual or an association of individuals are eligible to be registered as Section 8 Company if it holds below-mentioned intentions or objectives. The objectives have to be confirmed to the satisfaction of the Central Government.

When the company intends to promote science, commerce, education, art, sports, research, religion, charity, social welfare, protection of the environment or alike other objectives;

When the company holds an intention to invest all the profits (if any) or any other income generated after incorporation in the promotion of such objects only;

TWhen the company does not intend to pay any dividend to its members.

Society NGO: Seven people

National NGO: Eight people

The following are the steps involved in registering a section-8 in India:

RUN Name Approval (RUN - Reserved Unique Name)

Apply for DIN

Process of Incorporation

Preparing for MOA & AOA

Finally, we are getting COI (Certificate of Incorporation)

The following are the steps involved in registering a section-8 in India:

COI (Certificate of Incorporation)

MOA

aoa

PAN

TAN

Section -8 License

| KYC (Aadhaar, PAN, Voter ID, Email Id, Passport Size Photo, Signature, Mobile No.) |

| Utility Bill (Electricity Bill/Telephone Bill /GAS Bill) |

| Latest Bank Statement of all the Promoter/Subscriber/Members. |

| Rental Agreement with Business. |

| Others, if Any Required. |

1. How to Register a Company in India?

Digital Signature Certificate (DSC) Step 2: Director Identification Number (DIN) Step 3: Registration on the MCA Portal. Step 4: Certificate of Incorporation.

2. Are two directors necessary for registration of company?

Yes, a minimum of two directors are needed for a private limited company. The maximum members can be 200. You can register as a one person company, if you are the sole owner of the company.

3. Is it necessary to have a company’s books audited?

Yes, a private limited company must hire an auditor, no matter what its revenues. In fact, an auditor must be appointed within 30 days of incorporation. Compliance is important with a private limited company, given that penalties for non-compliance can run into lakhs of rupees and even lead to the blacklisting of directors.

4. What is the minimum capital needed to do company incorporation?

There is no minimum capital required for starting a private limited company.

5. Does one have to be present in person for Company Incorporation?

The entire procedure is done online and one does not have to be present at our office or any other place for the incorporation. A scanned copy of the documents has to be sent via mail. They get the company incorporation certificate from the MCA via courier at the business address.